How to use good debt to your advantage in Canada

We always get asked questions from fellow Canadians on how to use debt in business and investing. Before getting into this questions, we want to diver into what is good debt and bad debt.

There truly is a difference between good debt and bad debt. Debt, and large amounts of it, can be a scary thing. But if used wisely, it could be an amazing tool in your journey to financial freedom.

Without going into too much detail, good debt is debt that is used to purchase assets that make you wealthier. A good example of good debt is a mortgage for rental real estate. Bad debt is debt that is used to purchase liabilities that make you poorer. A good example of bad debt is a car loan for a fancy car. For more information on good debt vs. bad dad, check out Robert Kiyosaki’s piece, “Learn How to Use Good Debt vs. Bad Debt”.

The biggest reason average Canadians get into debt trouble is because they do not have the income to support their debt. For example, their car loan does not provide them any income. If they lose their employment income, they cannot make their payments.

Likewise, the biggest reason investors get into trouble with debt is because they get reckless. They make investments on speculative plays, and they do not have the income to support them when things go south.

A good example of this recklessness by both average citizen would be the 2008 Financial Crisis in the U.S. In 2008, in the United States, one of the biggest issues in the crash came from extremely laxed lending practices and lending fraud (think NINJA loans, no income no jobs). There were people with no income and no down payments buying real estate.

Why would lenders lend to these people?

They would lend to these people because they could charge them higher interest rates than normally charged due to their riskiness (subprime loans). And when the payment got out of hand, they would refinance their house to help. When the market corrected, people walked away because their house was purring them into a negative equity position. When people walked away, lenders tightened up and access to credit dwindled down further, meaning there were no buyers to buy the house, and housing prices continued to fall. This is how average people were hurt by bad debt.

So what about investors?

Many investors refinanced their properties every chance they had, so they could use the money they pulled out to purchase another property. Their assets were buying assets. Sounds smart, but like we stated earlier, if the money isn’t yours, you need the income to support it. When everything crashed, properties were just not worth it to these investors anymore. Their equity was negative, they couldn’t increase their rent, and some of their tenants couldn’t pay their existing rents. So a lot of investors claimed strategic bankruptcies on these homes. They walked away and lost everything they put into them. This sounds scary, but when you take a step back, you realize they lost everything because they were reckless. Instead of having a few properties with good loan-to-value ratios, they had multiple properties with awful loan to value ratios. This was a get rich quick scheme!

So how do we use good debt, without getting too reckless?

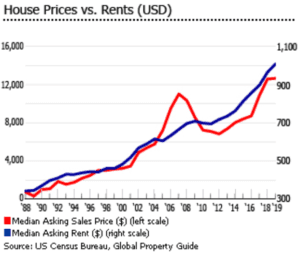

We take a slow and conservative approach. Our main focus is cashflow while being mindful of not being over leveraged. We think long-term and allow ourselves to weather every storm. If we look back to the 2008 crash, the investors that stuck with it came out in good shape. Why? Because while real estate prices dropped, rents stayed relatively stable, as shown in the graph below (people who lost their homes still needed a place to live).

Image taken from:

https://www.globalpropertyguide.com/

To quote the great Bo Schembechler, “Those who stay will be champions.” If we can learn anything from the 2008 crash, it is that if you can survive the short-term corrections/crashes, real estate will help you long-term. Same goes for anything including your business. If you can have a long-term perspective, while being aware of potential short-term blips along the way, you will make it out ahead.

So that brings us to our next question. How do we ensure we are being responsible while still trying to get ahead? We have created some rules that must be satisfied before utilizing debt in your business or investments.

5 Rules for Using Good Debt in Canada for Investment and Business Purposes

Rule 1: Have a personal emergency fund

Before investing in anything, make sure you have built up a personal emergency fund. If you follow rule 1, you have the funds to take care of you’re your personal finances in case of emergency (imagine Covid lock down with no CERB). We suggest at least 6 months of your current income.

Rule 2: Don’t invest in anything with less then 80% loan-to-value of the asset

In the example of real estate investing, most lenders in Canada won’t lend more than 80% of house’s value for an investment property. There are creative ways to get loans, such as private lending at high interest rates. We strongly encourage you to stay away from these opportunities. To us, the risks highly outweigh the rewards. By sticking to this rule, it gives you a buffer. If markets crash, you still have skin in the game that makes it a lot more difficult to walk away from your investment.

Rule 3: Don’t use leverage to purchase anything that does not provide safe, positive cashflow

This rule means you cannot use debt to perform real estate flips, purchase shares in speculative businesses, purchase flashy liabilities like cars, or purchase speculative crypto currencies. This rule to us is the most important rule. If we use the real estate example, history tells us that the cashflow does not disappear long term. If the property is providing you positive cashflow, who cares what the asset price is. Who cares about a crash. Hold the investment, use the cashflow to pay the bills, and wait for the market to turn around. On the flip side, if you get stuck with a quick flip in the middle of a crash, you’re in big trouble.

Rule 4: Ensure you have another 5% handy in cash for unexpected expenses related to your investment

When you meet the first 3 rules and get into an investment using debt, it is imperative that you have an extra 5% handy in your bank account for emergency expenses. This rule is meant to protect you from temporary blips in cashflow, which can happen in a crash (vacancies, evictions, unexpected breakdowns, etc.)

Rule 5: Do not refinance a previously purchased asset for more than 65% loan-to-value

This rule ensures that once you’ve tasted some success and appreciation, you don’t get addicted and give it all back. Instead, use your positive cashflow and income savings to buy more assets. As time passes, and you’ve made progress with your investment, why would you put all the risk back on the table?

While we believe these rules limit your risk and exposure, remember, these are not fool proof.

Using both good debt and bad debt have their risks associated to them. But when used wisely, good debt can be a great tool in your path to financial freedom. A path we like to call, “The Path to FU”.

Recent Comments