7 Cashflow Investments for Canadians

When I search for investments that produce cashflow in Canada, I seem to be always be pushed in the direction in real estate. I love real estate, but for some Canadians, it is difficult to get into. So I created this list of cashflow investments to get your brain gears spinning. There are so many investments that can produce cashflow, it is just up to you to allocate time and funds to them.

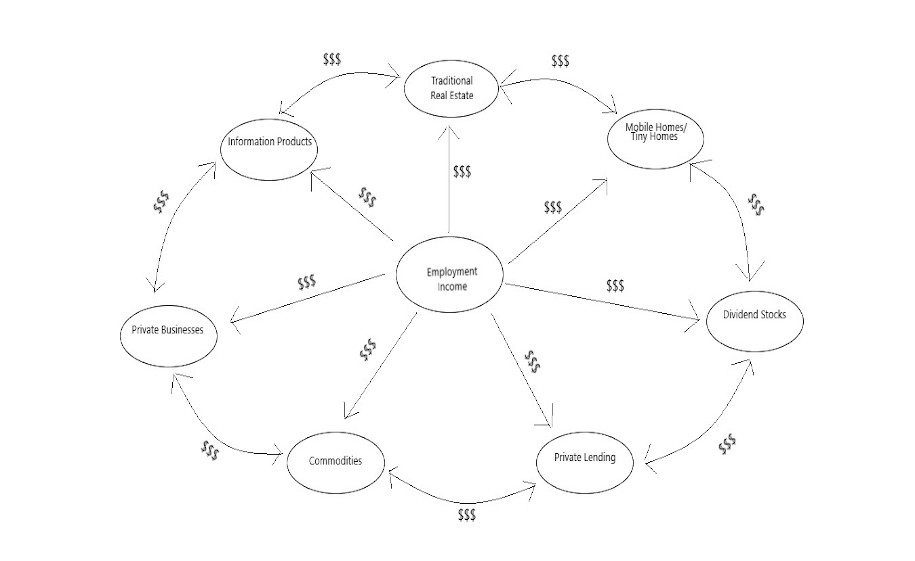

According to our studies and experiences, Canadians can invest for cashflow using these 7 ideas:

1. Traditional Real Estate

We list this first, as it seems to be the most common for most Canadians. This investment includes single family homes, multi-family homes, apartment buildings, and commercial real estate. The idea is to purchase the asset and collect rental income from prospective tenants.

2. Mobile Homes/Tiny Homes

As real estate prices have climbed, and the need for affordable housing has increased, mobile homes and tiny homes are a great way for a beginning investor to acquire cashflow through rental income. Mobile homes require smaller initial investments and can be done with little to no debt. These have been some of our best cashflow investments here in Canada.

3. Dividend Stocks

There are many great Canadian companies that offer a cash dividend when you purchase a share of their company. The best part, you can start building your cashflow with an investment as small as $10. This can be a great way to start your cashflow pipeline. For example, a $10,000 investment into Canadian publicly traded companies with an average of an 8% dividend would provide you with $800 of annual cashflow. You can then use these proceeds to purchase other income producing investments. If you would like learn more about building a dividend stock portfolio, check out our Stock Market Cashflow Course.

4. Private Lending

This usually requires large amounts of funds, but this can provide the ultimate passive cashflow. Typically, private loans are offered to borrowers at rates of 6-12% and they are usually backed by collateral. Very passive, but also requires large sums of money (ie. the full value of a home).

5. Commodities

These are not often talked about, but these can be great for increasing your cashflow. Examples of commodities include, grains, produce, oil, etc. To give you an idea on how these can be used, the black walnut tree is a great example. You can plant a black walnut tree for about $1. In a few years, these trees can produce 50-350 lbs of walnuts, which can be at $3 a pound. As a bonus, a mature walnut tree can be sold for up to $15,000. Not bad for an initial $1 investment. Building income through commodities can be labour intensive, but also very rewarding.

6. Private Businesses

By far the most labour intensive, owning and managing a business that produces income can also be your best investment to build cashflow in Canada. Most wealthy Canadian millionaires are a product of their business success. If you have a solid business idea, this can be the best investment of both your time and dollars that you can make.

7. Information Products

Do you have knowledge on a topic that others will see value in? Why not turn that into an information product? Many Canadians can create cashflow in their lives by creating an information product and selling it online. Some examples of information products include books, reports, and online courses. Information products are like assets that can provide you income for life.

These are 7 cashflow investment ideas that we have actually used successfully here in Canada. The point we are trying to make here is that there are multiple ways for Canadians to create cashflow in their lives. Sometimes it requires some creative thinking (ie. black walnut trees), but where there’s a will, there’s a way.

By focusing on cashflow, you unlock the door to true wealth. Cashflow compounds and layering these ideas on top of each other can work magic for your financial future. Originally, my brother and I relied on our employment income to purchase income producing assets. But today, after many years of sacrifice and acquisitions, it is our cashflow that is the primary driver to new acquisitions. When your cashflow buys cashflow, that is where the real magic happens. I even created a goofy diagram to show how you cashflow keeps flowing among investments (see above).

If you would like to learn more, feel free to check out our Canadian Cashflownaire Membership, where we share systems and ideas on investing for cashflow and building a financial fortress for you and your family.

Best,

Vince & Mike

Recent Comments